Because land is the only asset with zero competition and infinite dominance.

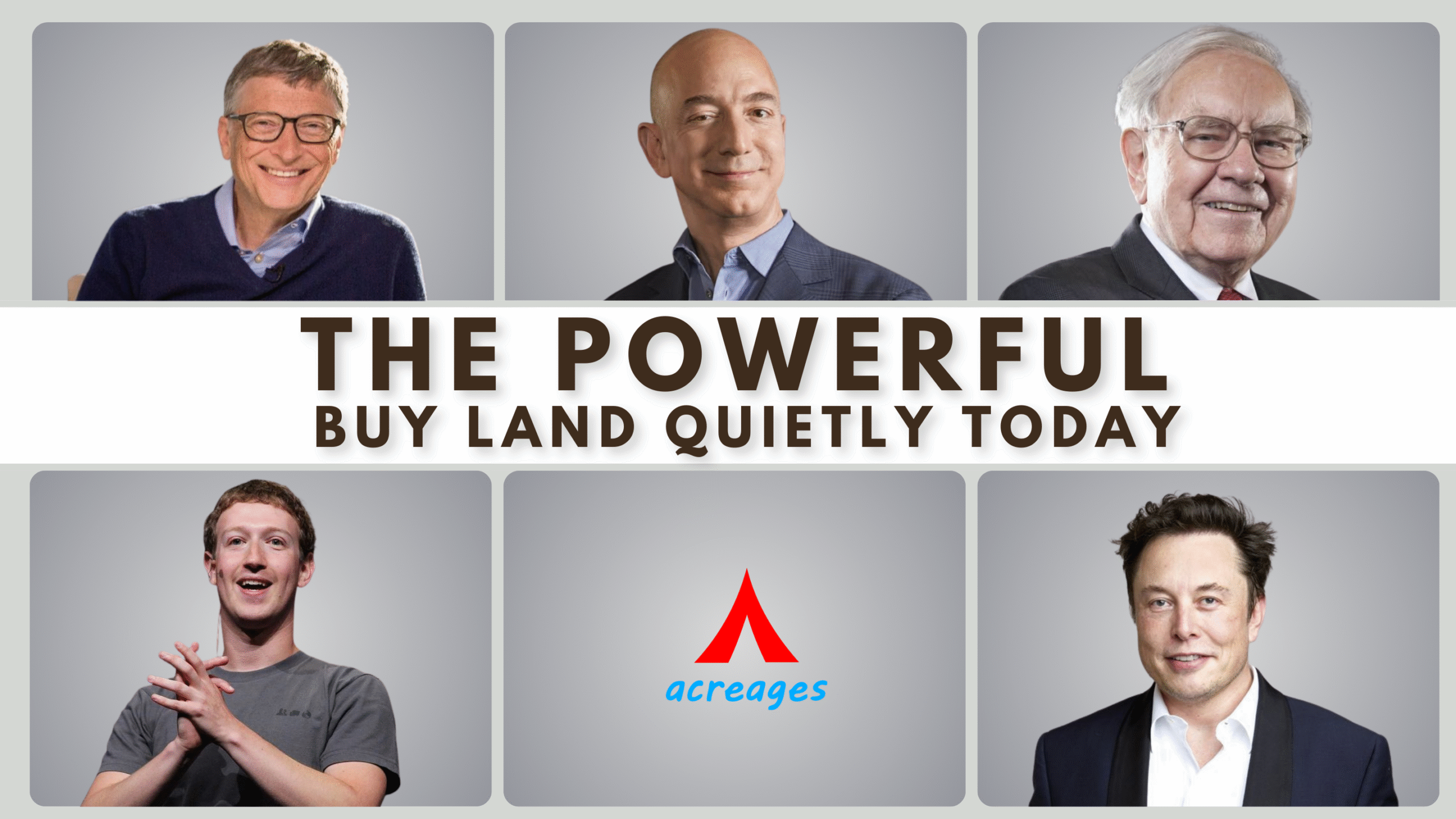

Look closely at the wealthiest individuals on this planet —

the tech giants, investment legends, royalty, industrial dynasties, old-money families.

Behind the companies, the empires, the headlines…

there is one silent, consistent strategy:

They buy land.

They accumulate land.

They protect land.

They never sell land.

Because land is the only asset class that is finite, indestructible, recession-proof, and immune to inflation.

Money loses value.

Markets fluctuate.

Startups rise and fall.

But land?

Land appreciates with time, demand, and progress — guaranteed.

This is the ultimate “insider strategy” of the global elite.

Let’s break down the mindset of the world’s top wealth creators.

⭐ 1. Bill Gates – The Architect of the Farmland Empire

270,000+ acres. A private agricultural kingdom.

Bill Gates did not become America’s largest farmland owner by accident.

This is strategic dominance.

His statement says it all:

“Farmland will shape the future of food, economics, and wealth.”

While the world debates inflation and markets,

Gates buys the one commodity no one can recreate — productive land.

His moves are aggressive, calculated, and long-term:

- Food security

- Climate-proof assets

- Sustainable revenue

- Multi-generational dominance

Gates is not buying land for today —

He’s buying land for the next 100 years.

⭐ 2. Jeff Bezos – Land as Power, Control & Infrastructure

Jeff Bezos is building more than Amazon —

He’s building territory.

His land acquisitions include:

- Massive ranches

- Rocket-launch sites

- Remote future-proof land parcels

- Strategic zones for logistics & innovation

Why would the richest man on Earth buy raw land?

Because Bezos understands:

“Control the land and you control the future.”

Markets fluctuate.

Tech evolves.

But land gives:

- Complete privacy

- Total control

- Permanent appreciation

- Infrastructure leverage

- Freedom from volatility

Bezos doesn’t buy land randomly.

He buys positions of power.

⭐ 3. Warren Buffett – The Oracle’s Simplest, Most Unbreakable Wealth Law

Buffett’s empire isn’t built only on stocks —

It’s built on farmland he accumulated quietly for decades.

His words echo through investment history:

“Buy land. They’re not making it anymore.”

Buffett’s formula is brutally simple:

Compound interest + land appreciation = generational wealth.

Not yearly income.

Not short-term profit.

But dynasty-level wealth that compounds for decades.

The richest families in America have held land since the 1800s —

and still do.

⭐ 4. Mark Zuckerberg – The Private Island Strategy

Zuckerberg is not buying land.

He’s buying geographic insulation.

His purchases in Kauai, Hawaii span thousands of acres —

transforming into:

- A private ecosystem

- A long-term wealth fortress

- A future scarcity asset

- A nature-backed investment hedge

Zuckerberg understands a truth most investors ignore:

Population increases. Land does not.

Scarcity = Power.

Land = Scarcity.

It’s a simple equation with an unstoppable outcome.

⭐ 5. Elon Musk – Land as the Launchpad of Innovation

Every major Musk revolution begins with land:

- Starbase

- R&D campuses

- Solar energy farms

- Manufacturing territories

For Musk, land is not just wealth.

It’s infrastructure for world-changing ideas.

His philosophy is sharp and unapologetic:

“If you control land, you control scale.”

No land = no expansion.

No expansion = no empire.

🌱 Why the Global Elite Choose Land Over Every Other Asset

Here’s the truth hidden behind boardrooms and private bank advisories:

✔ Land never loses value — buildings do

✔ Land requires near-zero maintenance

✔ Land is immune to inflation

✔ Land booms with every new highway, metro, airport, township

✔ Land creates passive income without effort

✔ Land becomes a legacy asset no one ever sells

✔ Land appreciates even when economies slow down

Every recession tells the same story:

People panic-sell everything except land.

Because land is the last man standing in every financial storm.

🌱 Middle-Class Investors Are the Next Land Millionaires

If Gates, Bezos, Buffett, Zuckerberg, and Musk are aggressively buying land…

Why are you waiting?

A small land investment today can become a crore-level asset tomorrow.

Especially in near Mumbai and Pune, where growth corridors like:

- Murbad

- New Mahabaleshwar

…are on the edge of massive development, infrastructure expansion, tourism demand, and urban overflow.

Prices are still accessible —

but not for long.

Every highway, every expressway, every township increases land value overnight.

🌱 Acreages – The Premium Partner for Wealth-Building Land Investors

Acreages doesn’t just sell land — it sells future wealth, lifestyle, and legacy.

Our land parcels are:

✔ Legally clean

✔ Strategically located

✔ Growth-ready

✔ Revenue-generating

✔ Ideal for weekend homes

✔ Perfect for long-term appreciation

With Acreages, you get:

- Income from farmstays

- Returns from plantations

- Passive weekend home revenue

- Strong appreciation in fast-growing zones

- A legacy asset for your next generation

This is not just buying land —

This is securing power.

🎯 Final Word: Land is Not an Investment. It is a Strategy.

The richest people in the world know one thing:

Buildings depreciate.

Cars lose value.

Markets crash.

Currencies weaken.

But land?

Land only rises.

Land only appreciates.

Land only strengthens your future.

If you want true wealth,

true freedom,

true security —

you start with land.

And the right time?

Right now.